Blog Information

- Posted By : Amit Sharma

- Posted On : Apr 16, 2025

- Views : 3

- Category : General

- Description : Iso E Super, a key component in the fragrance industry, has gained significant attention due to its unique woody and musky scent.

- Location : Sheridan, WY, USA

Overview

Iso E Super, a key component in the fragrance industry, has gained significant attention due to its unique woody and musky scent. As a cornerstone ingredient in fine perfumes and personal care products, understanding the Iso E Super price trend is vital for businesses, manufacturers, and suppliers navigating the global aroma chemicals market. This article delves deep into the latest price trends, market analysis, historical data, forecasts, and regional insights.

Request for the Real Time Prices: https://www.procurementresource.com/resource-center/iso-e-super-price-trends/pricerequest

What is Iso E Super?

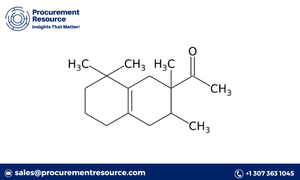

Iso E Super is a synthetic aroma chemical developed by International Flavors and Fragrances (IFF). Chemically known as 1-(1,2,3,4,5,6,7,8-octahydro-2,3,8,8-tetramethyl-2-naphthyl)ethan-1-one, it is valued for its subtle yet persistent scent, often described as cedarwood-like with a velvety amber quality.

It is extensively used in perfumes, deodorants, body sprays, and even in non-cosmetic applications like household air fresheners and detergents. Due to the versatility and demand for fragrance-enhancing additives, Iso E Super market trends are crucial to monitor for stakeholders in this industry.

Latest Iso E Super Price Trends

In recent months, the Iso E Super price trend has reflected the evolving dynamics in raw material availability, manufacturing costs, and regional demand fluctuations. Driven by the performance of the fragrance and cosmetics industry, the price trajectory of Iso E Super remains a subject of constant evaluation by market analysts.

Price movements are also closely tied to crude oil price trends, as Iso E Super is derived from petrochemical feedstocks. Any geopolitical shifts or supply chain disruptions have the potential to ripple across Iso E Super production lines, influencing costs for manufacturers and end-users.

Market Analysis of Iso E Super

Demand Drivers and End-Use Industries

The fragrance sector is the primary consumer of Iso E Super. With the growing inclination toward premium and niche perfumes, demand has surged across Europe, North America, and parts of Asia-Pacific. Additionally, the booming personal care industry in emerging markets is contributing to a consistent upward trajectory in the product’s consumption.

Key market drivers include:

- Rising disposable income and consumer spending on luxury fragrances.

- Innovations in fragrance formulations and product personalization.

- Increased usage in non-cosmetic applications like household and industrial cleaning products.

Supply Chain and Raw Material Analysis

The Iso E Super supply chain is interlinked with the global petrochemical network. Factors such as raw material cost volatility, logistics disruptions, and environmental regulations all influence pricing. The complexity of the synthesis process and dependency on specialty chemical manufacturers also add to the challenges in maintaining cost-effective supply chains.

Historical Data and Forecast for Iso E Super

The historical price data of Iso E Super shows both cyclical and seasonal patterns. Over the past five years, the price has experienced moderate fluctuations driven by crude oil price volatility, production adjustments, and changing consumer preferences in the fragrance segment.

Forecast Analysis (2025–2030)

Market analysts anticipate a stable to slightly upward trend in Iso E Super prices in the forecast period, factoring in the expected recovery of the global cosmetics industry and rising demand from the Asia-Pacific region. However, emerging competition from bio-based aroma chemicals and environmental scrutiny could temper aggressive growth scenarios.

Forecast insights include:

- Modest CAGR (Compound Annual Growth Rate) in line with fragrance market expansion.

- Gradual shift toward sustainable and greener manufacturing methods.

- Increasing investments in R&D for product enhancement and differentiation.

Iso E Super Market Insights

Key Manufacturers

Major producers in the Iso E Super market include:

- International Flavors & Fragrances (IFF)

- Takasago International Corporation

- Givaudan

- Symrise AG

- Privi Organics

These companies are heavily invested in innovation, scale, and sustainable sourcing. Strategic alliances and regional expansions also contribute to pricing and availability.

Regulatory Factors

Iso E Super is subject to regulations under REACH in Europe and FDA standards in the United States, especially in terms of its application in personal care products. Regulatory changes can impact production practices and cost implications across regions.

Regional Price Trends and Insights

North America

The North American Iso E Super market is shaped by a mature fragrance industry, high consumer awareness, and established distribution networks. Prices in the region are influenced by raw material imports and domestic manufacturing costs.

Europe

Europe leads the global market in terms of demand, particularly from the UK, Germany, and France. The region also emphasizes sustainable sourcing, which influences the pricing strategies of key suppliers.

Asia-Pacific

Asia-Pacific is an emerging hub, led by countries like China, India, and South Korea. The region benefits from lower manufacturing costs and a growing middle-class population driving demand for personal grooming products.

Latin America and Middle East & Africa

Though smaller in market share, these regions are seeing increased adoption of fine fragrances and luxury personal care items, which could potentially drive up demand and impact regional Iso E Super price movements in the future.

Iso E Super Price Chart and Database Access

A comprehensive Iso E Super price chart enables stakeholders to visually analyze market movements and plan procurement strategies. The database typically includes:

- Monthly and quarterly price averages

- Year-on-year comparison data

- Graphs depicting regional variations

- Data-driven market commentary

News and Industry Developments Impacting Iso E Super Prices

Recent developments that could potentially affect the Iso E Super pricing include:

- Strategic expansions by major fragrance houses into emerging markets.

- New product launches incorporating sustainable and bio-based aroma compounds.

- Environmental regulations pressuring manufacturers to innovate cleaner production methods.

- Logistic constraints in major export hubs.

Monitoring such events is essential for forecasting future price directions and planning long-term sourcing strategies.

Why Monitor the Iso E Super Price Trend?

Understanding the Iso E Super price trend is crucial for:

- Fragrance manufacturers aiming to manage production costs efficiently.

- Raw material buyers looking to negotiate favorable contracts.

- Retailers and brand owners strategizing product pricing and portfolio expansion.

- Market analysts and investors seeking market intelligence and growth opportunities.

With data-driven insights from Procurement Resource, businesses can make informed, strategic decisions in a dynamic and competitive marketplace.

Contact Information

Company Name: Procurement Resource

Contact Person: Ashish Sharma (Sales Representative)

Email: sales@procurementresource.com

Location: 30 North Gould Street, Sheridan, WY 82801, USA

Phone:

UK: +44 7537171117

USA: +1 307 363 1045

Asia-Pacific (APAC): +91 8850629517