Unlock the Secrets of Cold Wallets: Discover the Hidden Benefits and Risks for Your Cryptocurrency!

As the world of cryptocurrency continues to expand, securing digital assets becomes increasingly essential. One of the most effective ways to protect your investments is through the use of cold wallets. Unlike hot wallets, which remain connected to the internet, cold wallets are offline storage solutions that offer enhanced security for your cryptocurrency. In this article, we'll explore the concept of cold wallets, how they function, their numerous benefits, and the potential risks associated with them. By the end, you'll have a comprehensive understanding of cold wallets and how they can play a crucial role in safeguarding your digital assets.

Understanding Cold Wallets

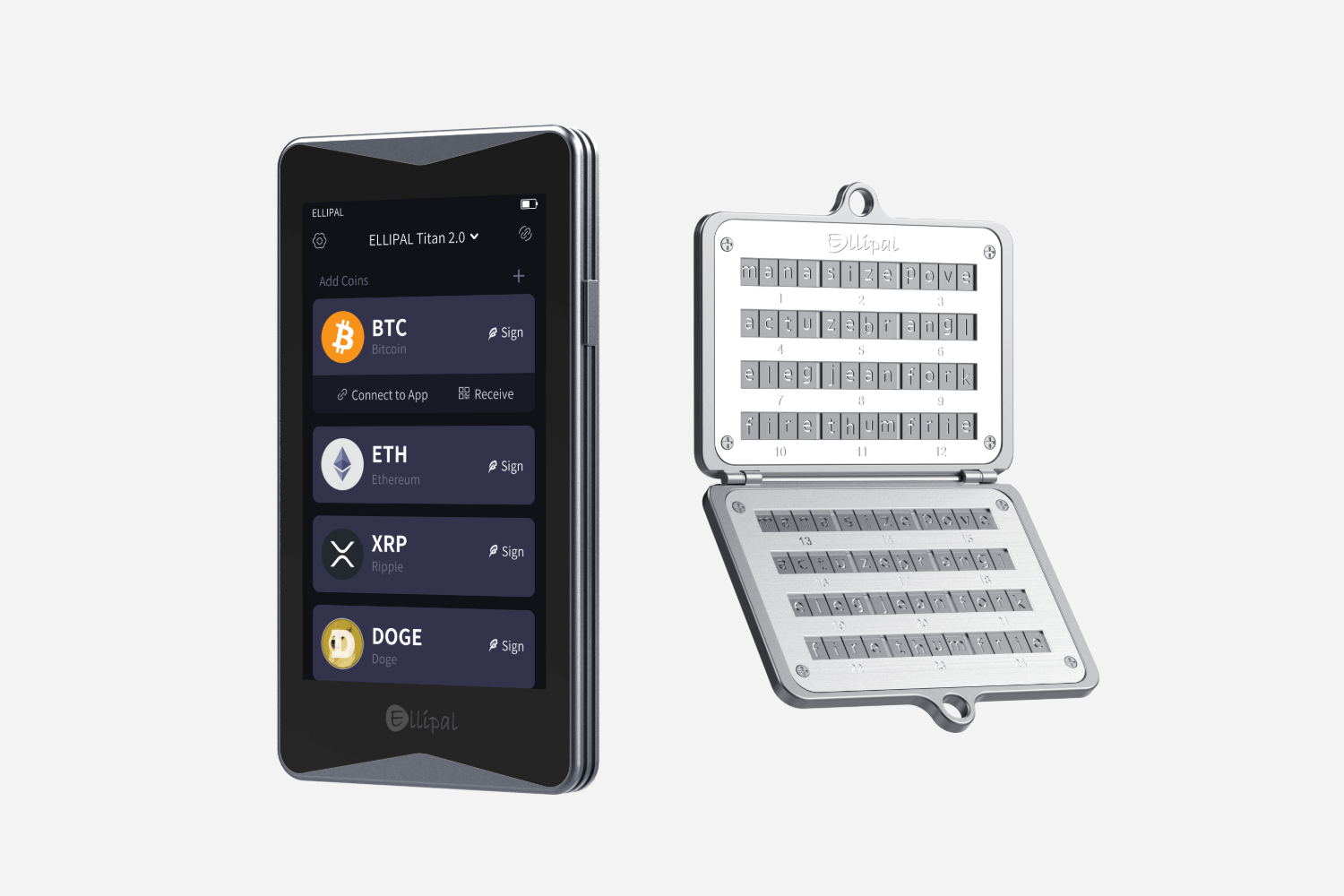

Cold wallets are specialized storage devices designed to keep cryptocurrency secure by storing private keys offline. This isolation from the internet significantly reduces the risk of hacking and unauthorized access. Cold wallets differ from hot wallets, which are online and more convenient for frequent transactions but expose users to greater security risks. The technology behind cold wallets involves hardware or paper wallets. Hardware wallets are small devices that securely store private keys and connect to a computer only when needed, while paper wallets involve printing your keys on paper, providing a physical form of storage. Each type has unique features that cater to different user needs, making it crucial to understand their operations before choosing one for your cryptocurrency storage.

Benefits of Using Cold Wallets

One of the primary advantages of cold wallets is their enhanced security. By storing private keys offline, cold wallets protect users from hacking attempts and malware attacks that target online wallets. This level of security is especially beneficial for individuals holding significant amounts of cryptocurrency or those who plan to keep their assets long-term. For instance, a friend of mine, who invested heavily in various cryptocurrencies, opted for a cold wallet after experiencing a phishing attempt that nearly compromised her funds. She now enjoys peace of mind knowing her investments are well protected. Additionally, cold wallets are ideal for long-term storage, allowing users to hold their assets without the need for constant monitoring. In scenarios where market fluctuations might tempt users to sell, having assets secured in a cold wallet can reduce the likelihood of impulsive decisions.

Drawbacks and Risks of Cold Wallets

While cold wallets offer substantial security advantages, they are not without drawbacks. One significant risk is the potential for physical loss. If a hardware wallet is lost or damaged, the cryptocurrencies stored on it may be irretrievable unless backed up securely. Furthermore, user error during setup can lead to mismanagement of recovery phrases or private keys, resulting in permanent loss of access to funds. Accessibility can also be an issue; unlike hot wallets, which allow for quick transactions, cold wallets require a bit more effort to access funds, potentially causing delays in urgent situations. Common misconceptions suggest that cold wallets are entirely foolproof; however, users must remain vigilant and follow best practices to mitigate these risks effectively.

Best Practices for Using Cold Wallets

To maximize the security of your cryptocurrencies stored in cold wallets, it's essential to follow certain best practices. First and foremost, always create backups of your wallet and recovery phrases in multiple secure locations. This precaution ensures that you can recover your assets in case of loss or damage. Additionally, consider using a combination of hardware wallets and paper wallets to diversify your storage methods. Physical security measures, such as keeping your cold wallet in a safe or a secure location, are also crucial. Lastly, remain informed about potential threats and scams in the cryptocurrency space, as vigilance is key to protecting your investments. By implementing these best practices, you can enjoy the security and peace of mind that cold wallets offer.

Secure Your Cryptocurrency Effectively

In conclusion, cold wallets present a robust solution for securing cryptocurrencies, offering significant benefits such as enhanced security and long-term storage capabilities. However, potential risks, including physical loss and accessibility challenges, must be carefully considered. As the cryptocurrency landscape evolves, it's vital for investors to stay informed and make educated decisions regarding their storage options. Ultimately, whether you choose a cold wallet or another method, prioritizing the security of your digital assets is paramount in this exciting and dynamic arena.

Comentarios